Loan Processing System

At Acuriq, we bring you an advanced online loan processing solution designed to streamline and accelerate the entire loan cycle. Our innovative loan processing system empowers lenders to handle more applications with greater efficiency, ensuring that your customers enjoy a seamless experience.

Why Choose Acuriq?

Quick Loan Processing

Our smooth application is optimized for Quick Processing, reducing manual tasks and promote automating complex workflows. Whether you’re dealing with mortgages, personal loans, or business financing, Acuriq helps you close deals quicker.

Digital Mortgage Solutions

Seamless Digital Loan Processing

Main Features

24/7 Online Loan Processing

Enhanced compliance with industry regulations

Customizable workflow automation

Comprehensive borrower dashboards

Secure cloud-based infrastructure

Benefits for Brokers

Increase Efficiency: Manage a higher volume of loans with fewer resources.

Reduce Costs: Lower operational costs through automation and reduced paperwork. In fact, the need to even pay for an LOS is removed.

Improve Customer Satisfaction: Offer faster processing times and digital convenience.

Ready to elevate your loan processing system? Reach out today to discover how Acuriq can revolutionize your lending operations

# Why Choose Acuriq?

Automated Workflows: Our system automates many of the complex workflows that are usually handled manually. This means fewer chances for errors and faster processing times

Quick Turnaround: By reducing the time needed for tasks such as data entry and document handling, Acuriq helps you close deals more quickly. This is crucial whether you’re processing mortgages, personal loans, or business financing.

The mortgage industry is rapidly moving towards digital solutions, and Acuriq is at the forefront of this shift. Our platform offers fully Digital Mortgage capabilities, ensuring that you can meet the demands of modern borrowers.

End-to-End Digital Applications: Borrowers can submit their applications online, avoiding the need for physical paperwork and in-person visits. This not only speeds up the process but also adds a layer of convenience for your clients.

Document Verification: With Acuriq, document verification is handled digitally. This means that you can quickly verify necessary documents such as income statements and identification without waiting for physical copies.

Real-Time Updates: Transparency is key in any transaction. Our system provides real-time updates, so borrowers are always aware of their application status, which helps build trust and reduce anxiety.

Acuriq’s Digital Loan Processing system is designed to eliminate the hassles associated with traditional loan handling. Here’s how we make the process smoother and more efficient:

Online Submissions: Borrowers can easily submit their loan applications online, which reduces paperwork and speeds up the initial stages of processing.

Automated Underwriting: Our platform includes automated underwriting tools that evaluate loan applications quickly and accurately. This helps in making faster and more informed lending decisions.

Streamlined Approvals: Every step of the loan process, from submission to approval, is streamlined and optimized to ensure that loans are processed as quickly as possible.

# Key Features

Acuriq’s platform comes packed with features designed to enhance the loan processing experience for both lenders and borrowers. Here’s a look at some of the key features:

24/7 Online Loan Processing: Our system operates around the clock, allowing borrowers to apply for loans and lenders to process applications anytime, anywhere. This flexibility helps in accommodating clients across different time zones and schedules.

Enhanced Compliance with Industry Regulations: Compliance is crucial in the financial industry. Acuriq’s platform is designed to meet industry regulations, ensuring that your loan processing adheres to legal requirements.

Customizable Workflow Automation: Not all loan processes are the same. Our platform allows for customizable workflows, so you can tailor the system to fit your specific needs and preferences.

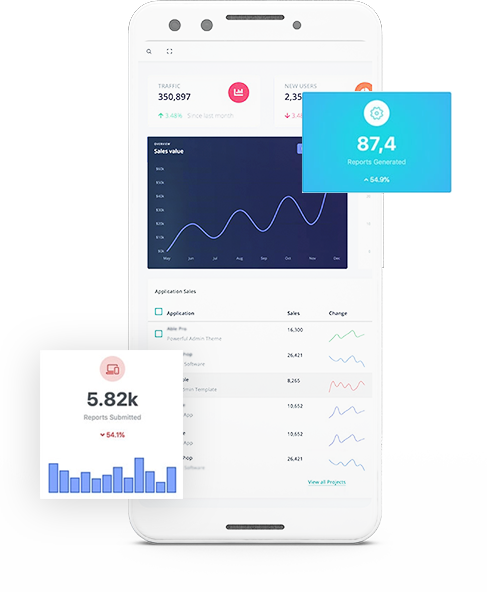

Comprehensive Borrower Dashboards: Borrowers can track their application status and manage their loan details through a user-friendly dashboard. This transparency improves customer satisfaction and keeps clients informed throughout the process.

Secure Cloud-Based Infrastructure: Security is a top priority. Acuriq uses a secure cloud-based infrastructure to protect sensitive data and ensure that all information is safely stored and easily accessible.

# Benefits for Brokers

Acuriq isn’t just beneficial for lenders; brokers also stand to gain a lot from using our platform. Here’s how:

Increase Efficiency: With Acuriq, brokers can handle a higher volume of loans without needing to add more resources. The automation of various tasks means that you can process more applications with the same or fewer staff.

Reduce Costs: Traditional loan processing involves a lot of paperwork and manual work, which can be costly. By automating these processes, Acuriq helps lower operational costs. In fact, the need to pay for a separate Loan Origination System (LOS) can be removed, saving even more money.

Improve Customer Satisfaction: Clients today expect fast and convenient services. With Acuriq’s faster processing times and digital conveniences, brokers can offer an improved experience that meets these expectations. This not only boosts customer satisfaction but also enhances your reputation as a forward-thinking and efficient broker.

In summary, Acuriq is transforming loan processing by offering a solution that combines speed, efficiency, and digital innovation. Our platform is designed to streamline the entire loan cycle, from application to approval, making it easier for lenders and brokers to manage their workload and for borrowers to experience a smooth, hassle-free process.

Support

Should you need any help with our platform get in touch with us

Knowledgebase

Using any of our products and need help? Get in touch with customer support